Speculate, Hedge or Earn Premiums from NFT Options

NFTCall is an NFT options trading platform on Layer-2 that uses a peer-to-pool model and auto market making mechanism.

What is NFTCall?

Peer-to-pool model

Inspired by GMX, Gains Network and Lyra, we adopt the peer-to-pool model for cash-settled NFT options. The liquidity pool will automatically provides market-making services through an AMM model, allowing traders to purchase both call and put options against the liquidity pool.

Cash-settled NFT Options

Compared to NFT-settled options, NFTCall’s cash-settled NFT options creates a more flexible trading experience without royalties and provides a lower entry barriers for traders who are interested in gaining exposure to NFT price fluctuations.

Auto market making

The core mechanism of the AMM is to increase the cost of NFT options when demand for options is high and decrease it when supply is high. By taking this approach, the AMM can reach a market-clearing value for NFT options with any strike and expiry, and effectively manage the risks associated with options trading for LPs.

Why trade NFT options on NFTCall?

Speculation

Speculating on the future price trend of an NFT collection can be profitable regardless of whether the floor price rises, falls, or fluctuates within a range.

Hedging

NFT holders can use NFT options to hedge against the risk of a drop in NFT prices.

Yield

Liquidity providers deposit liquidity into the vault as option sellers and use NFT options to generate income or revenue.

Leverage

Options have similar market exposure to owning an NFT, but require less money, providing more leverage and flexibility for investment portfolios, especially for high-priced blue-chip NFTs.

Available on popular Layer-2 networks

NFTCall will be deployed on Arbitrum and ZkSync Era.

Arbitrum

ZkSync Era

Start Trading Now!

Speculate, hedge and earn income from NFT options.

FAQs

What is an NFT Option?

An option gives the holder the right to buy (call option) or sell (put option) an asset at a specified price (the strike price) at a certain time (expiration).

Example: The ETH 3000 strike call expiring in 14 days gives the holder the right to purchase 1 ETH for $3000 in 14 days' time.

Options are one of the most traded products in global financial markets. NFTCall introduce this simple definition into the NFT world, giving a universe of possibility to NFT traders.

In terms of NFT options, the example above would change into:

NFT Option Example: The BAYC #3211 75 strike call expiring in 14 days gives the holder the right to purchase the Ape NFT for 75 ETH in 14 days' time.

How does NFTCall work?

NFTCall has two key user groups, namely liquidity providers and NFT options traders.

Liquidity providers (LPs) deposit liquidity into the vault as NFT option sellers. The vault automatically provides market-making services through an AMM model, helping LPs earn NFT option premiums.

NFT Option traders use NFTCall to buy call or put options for speculation or hedging risks. Options buyers need to pay option premiums to LPs, and the pricing of NFT options is determined by the AMM module and Black-Scholes formula.

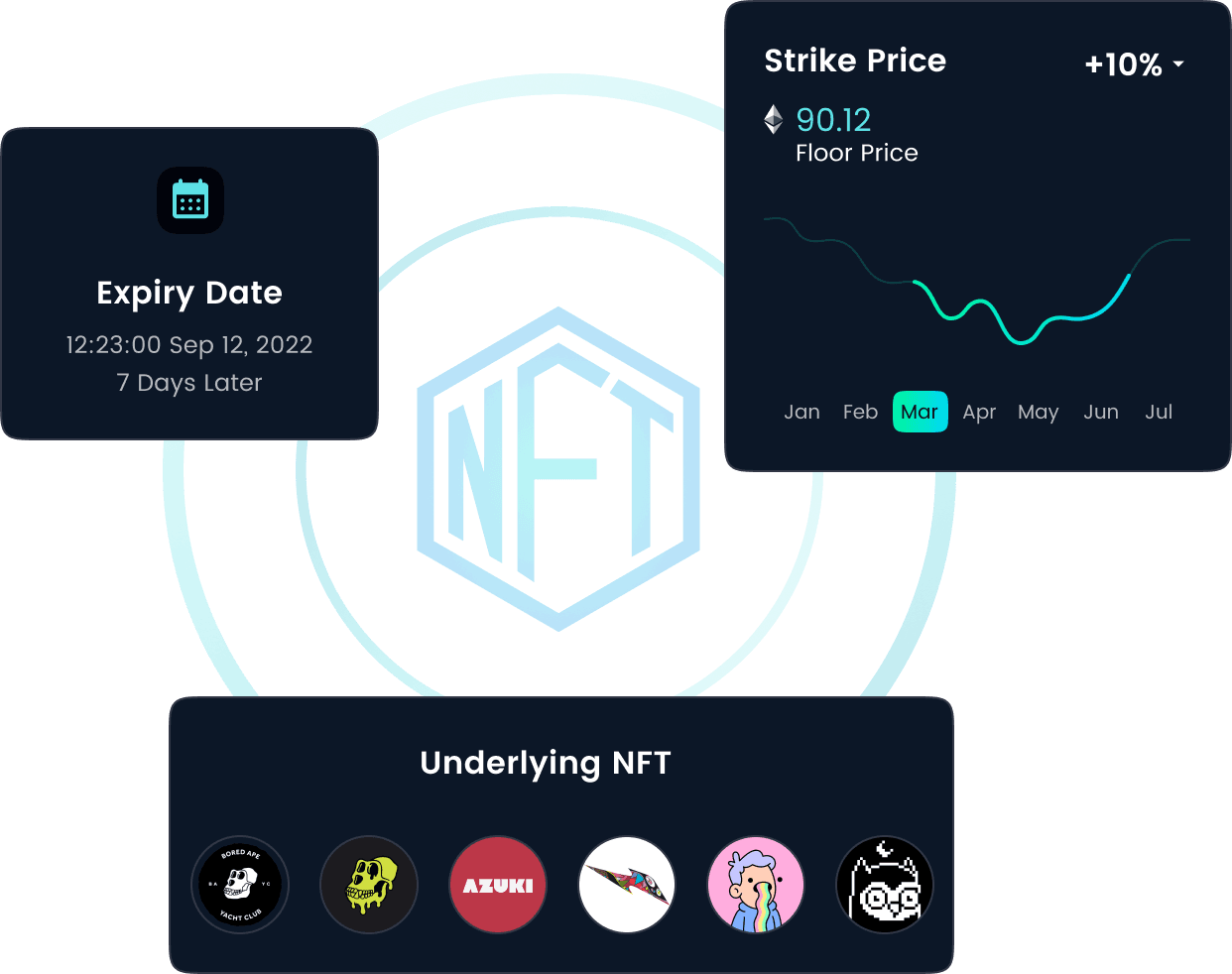

NFTCall currently supports European-style options, which are settled in cash and can only be exercised at expiration. In addition, the protocol uses floor prices to evaluate the price of each NFT collection uniformly. When opening a position, options buyers can choose any out-of-the-money (OTM) strike price within a range, in other words, buyers can purchase NFT covered calls and protective puts in the platform.

How do I buy NFT options?

Browse to the 'Trade' section and choose a collection for the NFT options you want to buy.

Select a direction (Call or Put) and set the size, strike price and expiration date on the right panel. Then you can preview the total premium of the option, press 'Open Position' button on the right panel to finalize the transaction.

How to exercise my NFT options?

For exercising an NFT option, user does not need to send a request, the keepers will automatically execute a transaction to exercise the option.

When an NFT option is exercised, a exercise fee will be charged by the protocol, which is 0.5% of the notional value or 12.5% of the option value, whichever is lower.

What happens when my NFT options expire?

The NFT option is invalid and no exercise fee will be charged.

What is ncETH Vault?

ncETH Vault is an WETH vault that follows ERC-4626, a standard API for tokenized yield-bearing vaults that represent shares of a single underlying ERC-20 asset. For this vault, ncETH shares are representative of the underlying WETH asset.

The vault serves as the counterparty to all NFT options trades made on the platform: When traders win (positive PnL), their profits will be paid by the vault; when traders lose (negative PnL), their losses (premiums) will be obtained by the vault.

90% of the premiums will be sent to the vault, while the remaining 10% will be treated as protocol income.

What is ncETH?

ncETH is an ERC-20 representing ownership of the underlying WETH asset. It follows an exchange rate model (similar to Compound's cTokens) where the price of ncETH to WETH changes in real-time from two variables: accumulated option premiums and trader options value (open options).

How does the vault manage the risks?

The protocol aims for the ncETH vault to be close to delta-neutral, reducing PNL fluctuations for LPs and aiming to ensure that returns are driven by market making.